Current trends provide an opportunity to rectify this anomaly. Can India take it up when it matters?

Post liberalisation, the grand telecom story has been a flagship

of India’s corporate prowess, and has developed business models that are benchmarks for players across the world. However, the flip side of the story is that while players, both Indian and international, have lined up in good numbers for the telecom services space, a similar exuberance wasn’t visible in the telecom handset manufacturing space in the initial years.

of India’s corporate prowess, and has developed business models that are benchmarks for players across the world. However, the flip side of the story is that while players, both Indian and international, have lined up in good numbers for the telecom services space, a similar exuberance wasn’t visible in the telecom handset manufacturing space in the initial years.Slowly but surely, the MNCs that saw India as a market also started seeing its potential as a manufacturing hub. LG has manufacturing facilities for handsets near New Delhi and on the outskirts of Pune. It is further planning now to set up a facility in South India to export handsets from here to European and CIS countries. Its Korean counterpart Samsung also manufactures mobile phones at its facility in Chennai. Market leader Nokia set up its plant at Sriperumbudur, Chennai, with a manufacturing capacity of 5,00,000 units per day. The Indian Cellular Association (ICA) came out with a report titled ‘Enabling the mobile handset and component manufacturing value chain in India’ in 2005, where it had mentioned that indigenous design and manufacturing would help companies achieve higher localisation.

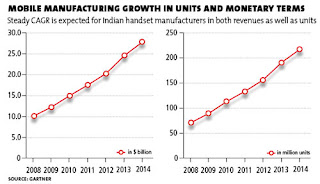

Considering the present scenario, the field is expected to split wide open now with the right impetus. India has become the world’s second largest mobile handset market with the sales expected to reach 140 million units in 2010 and grow to 206 million units in 2014, a CAGR of 20% (Gartner). Trends could soon change, considering the thrust being provided by the emerging domestic players who have eaten up a substantial market share from established international players in a short time. As was reported by IDC some time back, market leader Nokia saw its market share drop alarmingly to 36.3% in 2009 compared to 54% in the previous year due to players like Micromax, Spice, Lava, Karbonn and G’Five.

They are likely to follow the trail of the MNC giants before them and get into full fledged manufacturing. Sure enough, Micromax is expected to invest half of the money raised through its upcoming IPO to set up a manufacturing unit in Chennai. Other players like Videocon, Lava, Wyncomm and Karbonn are planning to start manufacturing operations, while Spice has commenced trial production. In fact, even Chinese players like ZTE and Huawei feel that the 5-10% of benefit on shipping from China is attractive enough to set up operations here. “With most local companies including ourselves seriously considering manufacturing in India, the country seems to be emerging not only as the second biggest EMS location but also a mobile manufacturing hub,” says Arvind Vohra, Co-Founder & MD, Wynn Telecom Ltd.

There are major reasons for visualising India as a global manufacturing hub or production factory.

Firstly, the cost effectiveness of manufacturing in India. Ganesh Ramamoorthy, Analyst, Gartner, states, “The opportunity is very high to set up a manufacturing base in India. Two factors are involved for decision (to manufacture) – volume targetted by companies and business model used.” Mobile connections in India will grow by 27.3% in 2010 to reach above 660 million with revenue of $19.8 billion to be generated (mobile services). Along with this, mobile penetration for 2010 is projected at 55.9%, which is expected to reach 82% by 2014. Mobile production revenue in India is expected to grow from $10.14 billion to $28 billion at a CAGR of 18.1% (Gartner). According to Pankaj Mohindroo, President, ICA, “Around 135 million phones were manufactured in India last year, which is 11% of total global manufacturing. Out of this number, around 70 million were exported.” The plan is to take the share to 20%. There are people who contest these figures, saying that manufacturing in India is actually more of assembling.

Firstly, the cost effectiveness of manufacturing in India. Ganesh Ramamoorthy, Analyst, Gartner, states, “The opportunity is very high to set up a manufacturing base in India. Two factors are involved for decision (to manufacture) – volume targetted by companies and business model used.” Mobile connections in India will grow by 27.3% in 2010 to reach above 660 million with revenue of $19.8 billion to be generated (mobile services). Along with this, mobile penetration for 2010 is projected at 55.9%, which is expected to reach 82% by 2014. Mobile production revenue in India is expected to grow from $10.14 billion to $28 billion at a CAGR of 18.1% (Gartner). According to Pankaj Mohindroo, President, ICA, “Around 135 million phones were manufactured in India last year, which is 11% of total global manufacturing. Out of this number, around 70 million were exported.” The plan is to take the share to 20%. There are people who contest these figures, saying that manufacturing in India is actually more of assembling.S. N. Rai, Co-founder & Director, Lava International Ltd. admits, “In the long-run China will not be too competitive as compared to India. In order to get the ball rolling for manufacturing in India the players need to achieve a ‘Critical Mass Production and Market Base’ which will make manufacturing here profitable.” Now it’s up to the government to seize the opportunity and ensure that the local handset industry gets the required force and capability to meet the demands in future. One of the key demands of the industry is to be provided STPI as was done for the IT industry. For a manufacturing sector to grow, the most vital aspect is the ecosystem and supply chain, where China has a huge advantage. Presently, very little component sourcing is happening in India. Only electrical and mechanical parts are made here whereas electronic components are all imported. Just as handset manufacturers are showing interest, the government needs to attract component vendors to set up production here, which will help keep the handsets competitive. A thrust at this critical time can do wonders for mobile handset manufacturing in India. It is a bus we can ill afford to miss.

For More IIPM Info, Visit below mentioned IIPM articles.

Professor Arindam Chaudhuri - A Man For The Society....

Arindam Chaudhuri: We need Hazare's leadership

IIPM BBA MBA B-School: Rabindranath Tagore Peace Prize To Irom Chanu Sharmila

GIDF Club of IIPM Lucknow Organizes Blood Donation Camp

Award Conferred To Irom Chanu Sharmila By IIPM

IIPM’s Management Consulting Arm - Planman Consulting

IIPM Lucknow – News article in Economic Times and Times of India

No comments:

Post a Comment