IIPM PUBLICATION

One

of the critical success factors for the steel sector will be captive iron-ore mines. Principally because of this highly scarce resource, the sector is magnetising players like Posco & Arcelor Mittal. Both have plans to set up 12 MTPA plants each. But at the moment, the government is refusing to play ball, leaving the players high & dry. Additionally, with more and more foreign players like Sinosteel, Nisshin et al planning to set up steel plants in the country, this battle for captive-iron ore mines will become more malevolent. Besides, energy supplies, hurdles inprocuring raw materials, logistics et al can act as mood dampeners. Sustaining the low cost advantage will be another mammoth challenge.

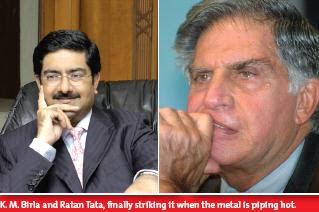

of the critical success factors for the steel sector will be captive iron-ore mines. Principally because of this highly scarce resource, the sector is magnetising players like Posco & Arcelor Mittal. Both have plans to set up 12 MTPA plants each. But at the moment, the government is refusing to play ball, leaving the players high & dry. Additionally, with more and more foreign players like Sinosteel, Nisshin et al planning to set up steel plants in the country, this battle for captive-iron ore mines will become more malevolent. Besides, energy supplies, hurdles inprocuring raw materials, logistics et al can act as mood dampeners. Sustaining the low cost advantage will be another mammoth challenge.The story for other metal sectors is not very different. For expansions, most players have taken significant debt and servicing them is difficult task. Currently, the debt/equity ratio of quite a few companies has taken a hit. K.M. Birla admitted on the Novelis acquisition, “The current debt-equity ratio of Hindalco, at 0.2-0.3 will definitely go up.” In future, it could become worse. Most of the metal sectors are now moving past their mid-points in the up-cycle. Overall plateauing of demand is a big threat, considering that these companies rely heavily on operating leverage. If this time the downturn comes up, the impact will be more severe. Are the metal players ready for this eventuality, or will those good ol’ skeptics be proved right once again?

For Complete IIPM Article, Click on IIPM Article

Source : IIPM Editorial, 2007

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

For More IIPM Article, Visit Below....

http://www.fairspirit.com/sonu00/

http://just-look.blogdrive.com/

http://sonu-hh.livejournal.com/

http://sonu501.wordpress.com

http://sonu119.zbloggy.com/

http://dearsonu.wordpress.com/

http://sonu72.tblog.com/post/1969892910

http://surenderlatwal.tripod.com/IIPM-B-SCHOOL/

http://surenderlatwal.tripod.com/IIPM/

http://businessmanagement.jeeran.com/

http://www-management-courses.ebloggy.com/

No comments:

Post a Comment